When investors and business leaders such as Warren Buffet, Bill Gates, Ray Dalio and Jamie Dimon all agree on a great place to invest, it’s usually worth listening. When some of the most admired companies globally including Apple, Amazon, Microsoft, Tesla, Samsung and Nokia and Boeing all make strategic long-term decisions to invest billions of dollars in a country, they probably have good reason.

So why are so many great investors and businesses so excited about the prospects for India and reallocating massive amounts of capital there? Whereas Western economies are saddled with debt and struggling for growth, India keeps surprising on the upside and this momentum is being rewarded by terrific returns in stock markets. India is already the 4th largest stock market in the world and that’s before it’s forecast to generate more growth in the coming decade than in its entire history. It’s simply too big to ignore.

What’s more, India’s growth is sustainable and driven by powerful local and international trends. Crucially, this growth is predictable and will last for several more decades. It’s hard to think of any growth trend in the world that is based on a greater certainty of trajectory.

Unlike much of the world, India has a young, highly driven and skilled population that is growing fast. This is driving vast urbanisation and a growing middle class that aspire to all the goods and services that Indian companies can offer. For every $1 currently spent by Indian consumers, US consumers are spending $150-200 on household goods, health care and entertainment. As Indian consumers get ever more prosperous, you can imagine what that will do for demand in every sector. What this means for us as investors is that we can achieve multi-bagger returns just by investing into sensible, cash generative businesses.

For too long, many investors have had little or no exposure to India, despite it being more like its own continent in terms of its population, market capitalisation or GDP. We are now witnessing a change. Every day we are approached by institutional and family office investors seeking access to the amazing opportunities available in India. It is fair to say that some investors can find it a little daunting knowing where to start. In a country with such strong tailwinds, you are likely to make money in most sectors over any reasonable time. However, the very best returns require on-the-ground specialist knowledge and a network of contacts built across several decades.

So, is this a 20-year story or do we need to get in right now? These trends are likely to last for decades but the most explosive phase of this growth is likely to be over the next few years driven by an extra HALF A BILLION Indians starting internet shopping. Just to put that into context, that’s 10x the population of Spain that will begin internet shopping for the first time.

Indian equities have performed well in the past with returns comfortably outpacing major Western and emerging markets. These returns have been driven by Indian companies delivering compound earnings growth that cannot be matched by international peers. Long term investors in India have been handsomely rewarded but we believe that the best is yet to come.

| USD | 25 Years Performance (%) | |

|---|---|---|

| Annualised | Cumulative | |

| MSCI India | 11.23 | 1333.22 |

| MSCI Emerging Markets | 8.54 | 677.40 |

| S&P 500 | 8.46 | 663.25 |

| MSCI China | 7.60 | 524.92 |

| MSCI All Country World Index (ACWI) | 7.40 | 495.93 |

| MSCI Europe | 5.99 | 328.08 |

| MSCI Japan | 4.09 | 172.89 |

If we had to sum up our edge in one word, it would have to be “access”. Yes, it’s possible to manage a portfolio of Indian equities from London or New York but without access, you really are at a massive disadvantage.

To illustrate this through an example – Imagine you want to really see the best of India as a tourist. Would you want to rely on someone who lives 3000 miles away and has only visited the place once or twice? Isn’t it quite likely they would just send you to see the same sights (like the Taj Mahal, for example) that all the guidebooks say? Would they be able to spot the truly special hidden gems of India? It’s the same for accessing the best of the Indian market.

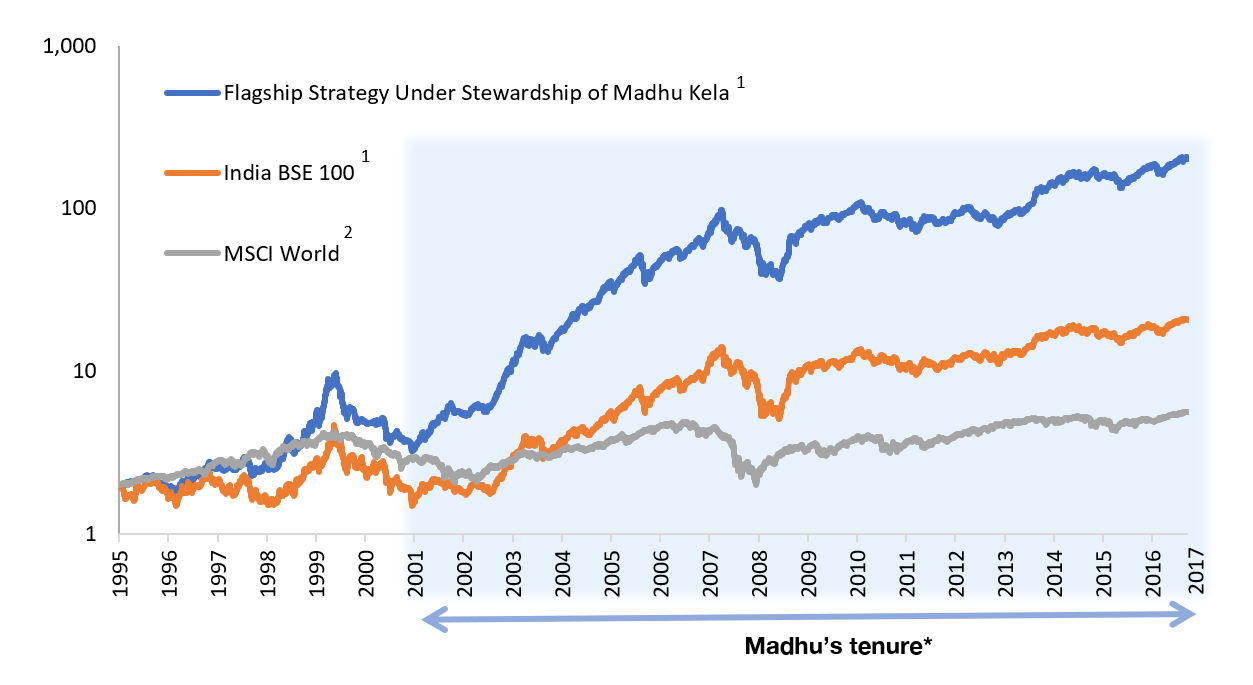

Cohesion’s access comes from our exclusive partnership with Madhu Kela. Madhu is arguably the best-known Indian equity investor of all time and known by many as simply, “The King of the Multi-Bagger”. A recipient of the Best Equity Fund Manager from the Prime Minister of India, Madhu built the Reliance Asset Management Indian equity business from less than $20mUSD to $60bnUSD. This growth was driven by the consistently exceptional investment performance delivered under Madhu’s stewardship. Madhu is supported by one of the strongest teams of managers and analysts, all hand-picked by him, and most of whom have worked alongside him for many years. The team is based in Mumbai with further support from senior colleagues across Asia and the Middle East.

| CAGR* | Total Return* | |

|---|---|---|

| Flagship Strategy Under Stewardship of Madhu | 28% | 5072% |

| India BSE 100 | 15% | 900% |

| MSCI World | 4% | 80% |

We are completely immersed in the Indian economy and in Indian markets. For any company we are interested in, we almost certainly have deep, close, personal relationships with their suppliers, customers, investors, bankers, current and ex management teams. We will know academics in their sector. We probably know government ministers and bureaucrats who oversee their sector and have an understanding of the policy nuances and longer-term vision for these sectors. The information we have access to simply isn’t available in a sell side note. They say that it’s better to be able to speak to the right person for 5 minutes rather than the wrong person for an hour. Madhu and his team can speak to the right person for an hour.

We have a clear advantage over most Indian managers in this regard but especially over generalist emerging market managers who might only spend a few days in India before flying off to South East Asia, Africa or Latin America. They tend to have a very superficial knowledge of our market. They are often the investors who base their opinions on what a stock or sector was doing 2 or 3 years ago rather than what it will be doing over the next year. We can think of countless examples of sectors and companies that have quietly completely reinvented themselves, but they are still viewed by Western investors as being the same as when they were last in Mumbai 2 years ago. Even whole sectors can change with a new piece of legislation or a change in government policy, but these often go under the radar unless you are full time on the ground, living and breathing the country and the market.

The ultimate test of the skills, knowledge and experience of a fund manager is of course in their performance. Since launch in August 2020, Cohesion MK Best Ideas has comfortably outpaced broad Indian benchmarks, our peer group and other international equity markets as demonstrated in the table below.

| 31 October 2025 (USD) | Performance (%) | |

|---|---|---|

| Since Inception CAGR 1 August 2020 |

Since Inception Return 1 August 2020 |

|

| Cohesion MK Best Ideas (USD) | 25.26 | 226.42 |

| Cohesion MK Best Ideas (GBP) | 25.14 | 224.74 |

| Nasdaq 100* | 18.42 | 142.97 |

| S&P 500* | 16.77 | 125.76 |

| MSCI All Country World Index (ACWI)* | 13.96 | 98.63 |

| Peer Performance** | 13.23 | 92.02 |

| MSCI India* | 12.07 | 81.93 |

| Nifty 50* | 11.62 | 78.11 |

| MSCI Emerging Markets* | 7.06 | 43.09 |

| MSCI China* | -0.24 | -1.26 |

Cohesion MK Best Ideas is our flagship fund. Through it, investors can access our very best money-making ideas.

Designed with the needs of institutional and private family offices in mind, Cohesion MK Best Ideas is the only way for global investors to access the talents of Madhu Kela and his team.

Typically, Cohesion MK Best Ideas will hold 20-25 stocks. The portfolio will be diversified across a range of different industries and themes at all times. However, Cohesion MK Best Ideas is likely to look very different from broad stock market indices as we will only ever own stocks in which we believe there is substantial upside and limited downside over an appropriate timeframe. With thousands of listed stocks to choose from, every holding has to earn its place, and we are happy to have no exposure to benchmark heavyweight stocks or sectors if we do not believe they have a high probability of delivering the sort of returns we seek.

Cohesion MK Best Ideas invests in main market listed stocks in India as this provides us the liquidity of one of the world’s oldest, largest and best regulated markets. Although we are investing in listed stocks, we adopt a private equity approach to the exhaustive due diligence that we undertake. We believe that this gives us the best of both worlds, private equity sized returns but with public market liquidity and governance.

Cohesion MK Best Ideas has been designed with strictly limited capacity to allow our investment managers to focus on delivering exceptional returns rather than AUM growth. This is in line with Spike and Madhu’s shared vision to place making money for our investors at the heart of all that we do.

We launched into the face of the tornado of Covid and the 2020 US presidential election. Despite taking a prudent approach we ended the year

having got off to a great start and making a lot of money although we were only part invested.

After the rollout of the Covid vaccine, markets performed well and we had a terrific 2021, making hay whilst the sun shone.

2022 turned out to be an awful year for most investors, a real year of thunder, lightning and black clouds. The darling global growth stocks were

hammered and the safe haven of bonds proved to be one of the riskiest places to be. Against that environment we protected investors capital.

We’ve described 2023 as “sunshine and showers”. For most investors it was less painful than 2022 but there were still plenty of places to lose

money. We had another terrific year, rising by 43% but crucially, we weren’t having to recover losses from 2022.

2024 was a year of progress for the world economy despite lingering global geopolitical concerns. Our strategy of identifying companies with very

significant upside and limited downside delivered a 50% portfolio return.

In 2025, our strategy remains the same as we aim to preserve and grow capital in the most exciting economy in the world.

Over these different seasons there have been some managers who have delivered fantastic results only when their market or their style has been in

vogue. What has really set Cohesion MK Best Ideas apart is our ability to nimbly adjust our approach between capital preservation and maximum

capital appreciation.

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| USD Performance (%) | ||||||

Cautiously deployed capital during Covid and US Presidential elections |

Post Covid-19 vaccination, markets performed well |

As inflation pressures mounted, equity and bond markets took fright. Many markets down 30-40% |

Markets remain choppy due to conflicting inflation data |

Our strategic focus on resilient companies, and a balanced emphasis on capital preservation delivered a robust 50% portfolio return, significantly outperforming local and international equity benchmarks as well as our peers |

We aim to preserve and grow capital in the most exciting economy in the world |

|

Cohesion MK Best Ideas |

+15% Data from 01/08/2020 |

+42% |

-2% |

+43% |

+50% |

-6% (YTD) |

MSCI India* |

24% |

22% |

-9% |

18% |

9% |

3% |

S&P 500* |

15% |

28% |

-18% |

26% |

26% |

17% |

As can be seen from the table below, Madhu and his team have recycled many of their winners into a portfolio that looks great value. Indeed, Madhu thinks that this portfolio is more exciting than it’s been for a long time. They are finding plenty of highly predictable winners with tailwinds behind them and trading on really attractive PEG ratios. The overall PEG ratio of the portfolio is currently less than 0.5 which compares incredibly well with either the broader Indian market or the S&P 500. So, when people ask whether India is expensive, our answer is “not if you know where to look”!

| 30 September 2025 | PE Valuation | Earnings Growth (%) | PEG Ratio | |

|---|---|---|---|---|

| 10YR PE | FY27E PE | FY27E | FY27E | |

| Cohesion MK Best Ideas* | - | 16.0 | 52.0 | 0.31 |

| Nifty 50 | 23.4 | 19.2 | 16.5 | 1.17 |

| MSCI India | 25.2 | 20.6 | 17.7 | 1.16 |

| MSCI India Small Cap | 34.3 | 23.8 | 24.9 | 0.96 |

| S&P 500 | 22.1 | 22.0 | 14.8 | 1.49 |